When it comes to safeguarding your future and protecting yourself and your loved ones from unexpected events, choosing the right insurance plan is crucial. With so many options available, it can be overwhelming to navigate through the various policies and find the one that best suits your needs. To help you make an informed decision, here are 5 essential tips for choosing the right insurance plan for you, brought to you by [Insurance].

1. Assess Your Needs and Prioritize Coverage

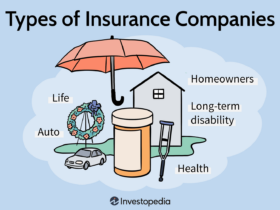

Before diving into the realm of insurance plans, take the time to assess your needs and prioritize the coverage that matters most to you. Whether it’s health, life, home, auto, or any other type of insurance, understanding your specific requirements will guide you in selecting the most fitting plan. Consider factors such as your financial situation, family dynamics, health conditions, and valuable assets that need protection. By prioritizing your coverage needs, you can narrow down the options and focus on plans that align with your individual circumstances.

2. Research and Compare Multiple Plans

The insurance market is rife with a plethora of plans offered by various providers. To make an informed choice, conduct thorough research and compare multiple plans. Look into the coverage details, premium amounts, deductibles, and exclusions of each plan. Pay close attention to the fine print and seek clarity on any ambiguous terms or conditions. Additionally, compare the reputation and track record of different insurance providers to ensure you choose a reliable company with a strong customer service ethos.

3. Consider Affordability and Long-Term Viability

While it’s important to prioritize comprehensive coverage, it’s equally crucial to consider the affordability and long-term viability of the insurance plan. Evaluate your budget and assess whether the premium payments are sustainable in the long run. Avoid opting for plans with exorbitant premiums that may strain your finances. Strike a balance between affordability and coverage to ensure that you can consistently maintain the policy without sacrificing other essential expenses.

4. Seek Professional Guidance and Clarify Doubts

Navigating the intricate landscape of insurance plans can be challenging, especially if you’re unfamiliar with the terms and jargon associated with the industry. Consider seeking professional guidance from insurance agents or financial advisors who can offer personalized insights based on your needs. Don’t hesitate to ask questions and clarify any doubts you may have regarding the coverage, policy intricacies, claim processes, or any other related concerns. A clear understanding of the plan is vital in making a well-informed decision.

5. Review and Reassess Periodically

Once you’ve chosen an insurance plan, the journey doesn’t end there. It’s imperative to periodically review and reassess your insurance needs and the suitability of the chosen plan. Major life events, changes in income, or fluctuations in your priorities may necessitate adjustments to your insurance coverage. Stay proactive in reviewing your policy to ensure that it continues to align with your evolving circumstances and provides the necessary protection for you and your family.

In conclusion, choosing the right insurance plan requires careful consideration, research, and a clear understanding of your needs. By following these 5 essential tips, you can navigate the process with confidence and select a plan that offers peace of mind and financial security. Remember, [Insurance] is here to support you in making informed decisions and securing a better tomorrow for you and your loved ones.