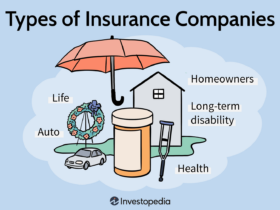

The world of insurance can often feel like a maze of complex terminology and jargon that leaves many individuals feeling overwhelmed and unsure of where to turn for clarity. However, understanding key insurance terms is crucial for making informed decisions about your coverage. In this comprehensive guide, we’ll break down essential insurance jargon to empower you with the knowledge you need to navigate the world of insurance confidently. Whether you’re a first-time insurance buyer or simply looking to brush up on your insurance vocabulary, this article aims to demystify the intricate language of insurance.

1. Policyholder: The individual or entity who owns an insurance policy. As a policyholder, you have the rights and obligations outlined in the contract, including making premium payments and complying with the terms and conditions of the policy.

2. Premium: The amount of money paid to an insurance company in exchange for insurance coverage. Premiums are typically paid on a regular basis, such as monthly or annually, and can vary based on factors such as coverage level, deductible, and the insured individual’s risk profile.

3. Deductible: The amount of money that a policyholder is required to pay out of pocket before their insurance coverage kicks in. For example, if you have a $500 deductible on your auto insurance policy and incur $1,000 in covered damages, you would be responsible for paying the first $500, after which the insurance company would cover the remaining $500 (subject to policy limits).

4. Coverage Limit: The maximum amount that an insurance policy will pay out for a covered loss. It’s important to understand your policy’s coverage limits to ensure that you have adequate protection in place. Common types of coverage limits include property damage, liability, and medical expenses.

5. Claim: A formal request made by the policyholder to the insurance company for compensation or coverage of a loss or damage outlined in the policy. When a covered event occurs, such as an auto accident or property damage, the policyholder initiates a claim to seek reimbursement or payment from the insurance company.

6. Policy Exclusions: Specific conditions, situations, or events that are not covered by an insurance policy. It’s crucial to review your policy exclusions carefully to understand areas where your insurance may not provide protection, such as pre-existing conditions, intentional acts, or certain types of natural disasters.

7. Underwriting: The process by which insurance companies evaluate the risks posed by potential policyholders and determine the coverage terms and premium rates. Underwriting involves assessing factors such as the applicant’s health status, driving record, and property condition to determine the level of risk and the corresponding insurance pricing.

8. Rider: Also known as an endorsement, a rider is an additional provision added to an insurance policy to modify or expand its coverage. Common examples of riders include adding coverage for specific valuables, increasing liability limits, or including specialized protection for unique assets or risks.

By familiarizing yourself with these fundamental insurance terms, you can approach the world of insurance with greater confidence and clarity. Remember that ongoing education and awareness are key to making informed insurance decisions that align with your unique needs and goals. Whether you’re researching a new insurance policy, reviewing your existing coverage, or seeking guidance on complex insurance matters, having a solid grasp of insurance terminology will equip you to engage effectively with insurance professionals and make well-informed choices.

As always, we recommend consulting with a qualified insurance advisor or agent to receive personalized guidance tailored to your specific circumstances. Insurance is a critical aspect of financial planning and risk management, and by gaining fluency in insurance terminology, you can take proactive steps to protect yourself, your loved ones, and your valuable assets. Embrace the empowerment that comes with understanding insurance jargon, and leverage this knowledge to make confident, informed decisions about your insurance coverage.