As a young adult, it’s easy to get caught up in the excitement of exploring new opportunities, traveling, and embarking on your career journey. However, amidst all this excitement, it’s crucial to consider the importance of securing your financial future. One key aspect of this is securing the right insurance coverage to protect yourself and your assets. In this blog, we’ll explore some valuable insurance tips tailored specifically for young adults, to help you make informed decisions and safeguard your financial well-being.

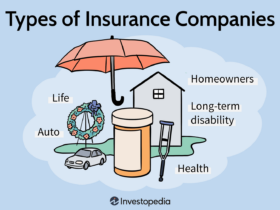

Health Insurance: Your Foundation for Health and Wellness

The foundation of any sound insurance plan is health insurance. While you may feel invincible in your youth, unexpected medical emergencies or illnesses can arise at any time. Having a comprehensive health insurance plan ensures that you have access to quality healthcare without being burdened by exorbitant medical bills. As a young adult, explore the options available to you through your employer, or consider individual plans that suit your specific needs and budget.

Renters Insurance: Protecting Your Belongings

If you’re renting an apartment or a house, it’s essential to consider renters insurance. This often-overlooked type of insurance provides coverage for your personal belongings in the event of theft, fire, or other unexpected disasters. Additionally, renters insurance may offer liability coverage, protecting you in the event that someone is injured while on your rental property. It’s a small investment that can provide significant peace of mind.

Auto Insurance: Safeguarding Your Vehicle and Finances

For young adults who own a car, auto insurance is a must. Not only is it a legal requirement in most places, but it also provides crucial protection in the event of accidents, theft, or damage to your vehicle. While it’s tempting to opt for the minimum coverage to save money, it’s important to carefully consider the level of coverage you need to adequately protect yourself and your finances. Also, explore potential discounts for good grades or completing a defensive driving course to save on premiums.

Life Insurance: Planning for the Unexpected

While life insurance may not be a top priority for many young adults, it’s an important consideration, especially if you have dependents or significant financial obligations. Life insurance can provide financial support to your loved ones in the event of your untimely passing, helping them cover living expenses, debts, or future financial goals. Obtaining life insurance at a younger age often means lower premiums, making it a prudent investment in your financial future.

Disability Insurance: Safeguarding Your Income

Protecting your ability to earn an income is vital at any age, but particularly crucial for young adults who are in the early stages of their careers. Disability insurance provides income protection if you are unable to work due to illness or injury. It acts as a safety net, ensuring that you can meet your financial obligations and maintain your standard of living, even if you are unable to work for an extended period.

Conclusion

Securing the appropriate insurance coverage may seem like a daunting task, but it’s a critical step in establishing a solid foundation for your financial future. As a young adult, taking the time to explore and understand the various insurance options available to you is an investment in your long-term financial well-being. By addressing your insurance needs early on, you can enjoy greater peace of mind, knowing that you have taken proactive steps to protect yourself and your assets. Remember, the decisions you make today can have a lasting impact on your financial security tomorrow.