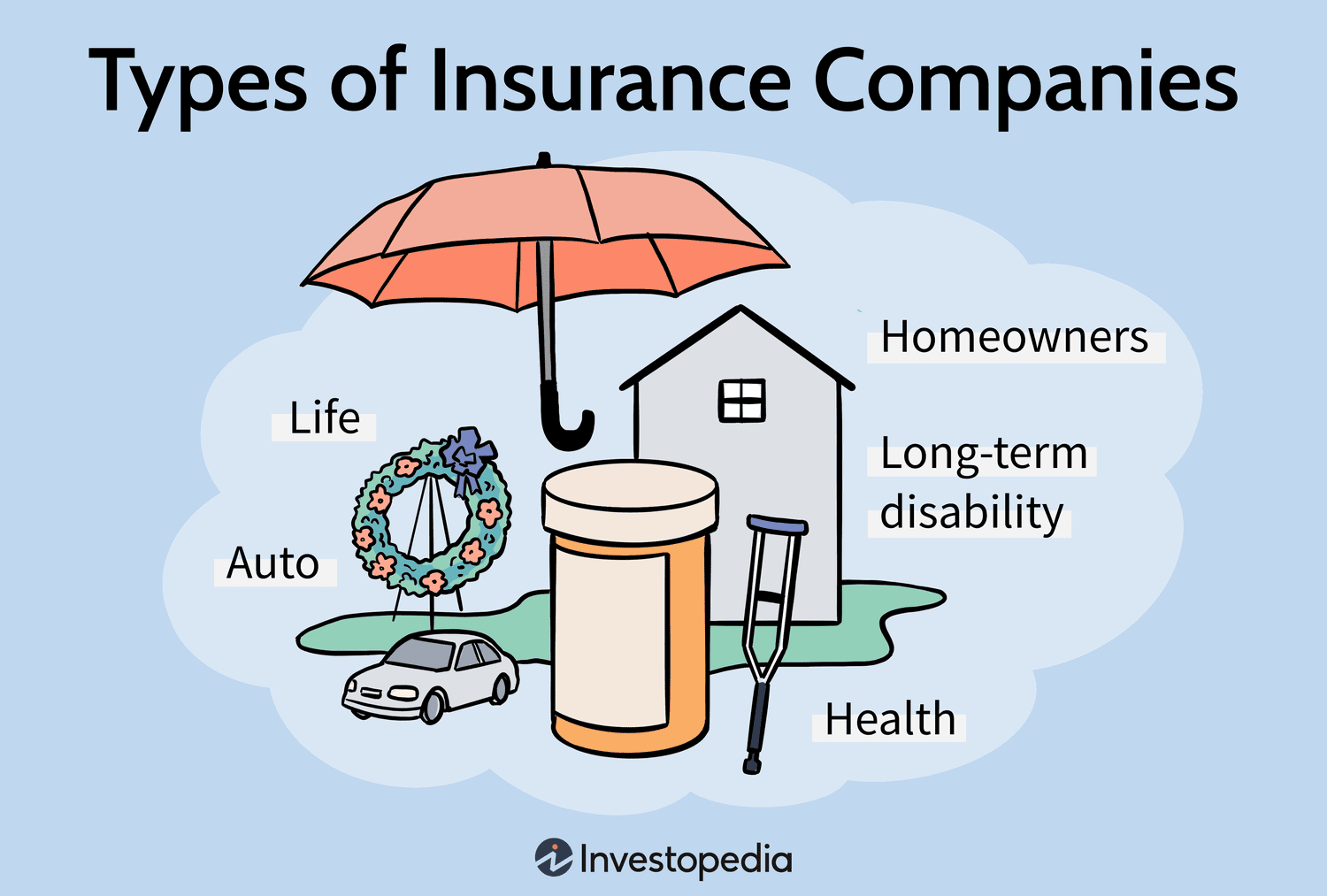

Insurance is a critical aspect of financial planning and risk management. It provides a safety net for individuals, families, and businesses, offering protection against unforeseen events that could otherwise have devastating financial consequences. Understanding the different types of insurance and their benefits is essential for making informed decisions about the coverage that best suits your specific needs. In this comprehensive guide, we will explore various types of insurance and their respective advantages, helping you navigate the complex world of insurance with confidence.

Health Insurance:

Health insurance is designed to cover medical expenses, including doctor’s visits, hospitalization, prescription medications, and preventive care. One of the significant benefits of health insurance is the ability to access quality healthcare without exorbitant out-of-pocket costs. In addition, it provides financial protection against unexpected medical emergencies, giving individuals and families peace of mind.

Life Insurance:

Life insurance serves as a crucial financial tool for protecting loved ones in the event of the policyholder’s death. It offers a tax-free lump sum payment to beneficiaries, which can be used to replace lost income, cover funeral expenses, pay off debts, or fund children’s education. The peace of mind provided by life insurance is invaluable, as it ensures that loved ones are financially protected during difficult times.

Auto Insurance:

Auto insurance is a legal requirement in many countries and provides coverage for damages resulting from auto accidents. It offers protection against financial liabilities, including property damage and medical expenses, and may also cover theft and vandalism. Furthermore, auto insurance can provide added benefits, such as roadside assistance and rental car reimbursement, enhancing the overall driving experience.

Home Insurance:

Home insurance safeguards homeowners against property damage and liability risks. It provides coverage for a range of perils, including fire, theft, natural disasters, and personal liability claims. Home insurance also offers peace of mind by providing financial protection for the structure of the home, personal belongings, and additional living expenses in the event of a covered loss.

Travel Insurance:

Travel insurance is essential for protecting against unforeseen events while traveling, such as trip cancellations, medical emergencies, lost baggage, and travel delays. It ensures that travelers are financially protected and provides access to emergency assistance services, including medical evacuation and 24/7 support. Additionally, travel insurance offers peace of mind for both domestic and international travel, allowing individuals to explore the world with confidence.

Business Insurance:

Business insurance is vital for protecting businesses against various risks, including property damage, liability claims, and business interruption. It offers coverage for property, inventory, equipment, and liability exposure, enabling businesses to recover from unexpected setbacks and continue operations. Business insurance also provides protection against legal expenses and employee-related risks, contributing to the long-term stability and success of the enterprise.

Conclusion:

In conclusion, insurance plays a fundamental role in mitigating risks and providing financial security for individuals, families, and businesses. By understanding the different types of insurance and their respective benefits, individuals can make informed decisions to protect their assets and loved ones. Whether it’s health, life, auto, home, travel, or business insurance, each type offers unique advantages that contribute to peace of mind and financial resilience. As you navigate the world of insurance, consider your specific needs and priorities, and seek the guidance of insurance professionals to secure comprehensive coverage that aligns with your goals and circumstances. With the right insurance protection in place, you can face the future with confidence and security.

[Pencilo Media Thailand] is dedicated to providing valuable insights and information on insurance and financial topics to empower individuals in making informed decisions. Stay tuned for more informative content on insurance and related subjects.